The following information is available from the Carson Company accounting records:

| 1) | Cash account balances: January 1, 2008, $43,000; December 31, 2008, $18,000. | ||||||||

| 2) | The balance in accounts receivable decreased by $10,000 during the year from $60,000. The company had no short-term investments. | ||||||||

| 3) | Inventory increased $9,000 to $80,000. | ||||||||

| 4) | Accounts payable increased $3,000 during the year to $32,000. Income tax payable increased $4,000 during the year to $8,000. Wages payable decreased by $5,000 to $4,000. There were no other current liabilities. | ||||||||

| 5) | During December 2008, the company settled a $10,000 note payable by issuing shares of its own capital stock with equivalent value. | ||||||||

| 6) | Cash expenditures during 2008 were:

| ||||||||

| 7) | Sale and issuance of Carson Company capital stock for $20,000 cash. | ||||||||

| 8) | Issuance of long-term mortgage note, $30,000. | ||||||||

| 9) | Sale of some old operational assets resulting in the following entry: | ||||||||

| |||||||||

| 10) | Income statement data: | ||||||||

|

Instructions

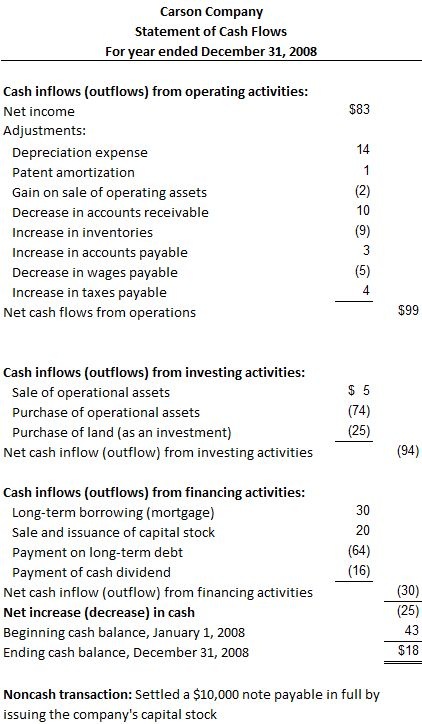

- Prepare a statement of cash flows in thousands of dollars using the indirect method.

- Calculate the following ratios: (a) Current ratio; (b) Quick ratio; (c) Working capital to total assets; (d) Accounts receivable turnover; (e) Age of accounts receivable; (f) Inventory turnover; (g) Working capital turnover; (h) Net cash flow to current liabilities; (i) Profit margin on sales; (j) Dividend payout ratio (income based).

Solution

Instruction 1 statement of cash flows

Instruction 2 ratio analysis

(a) Current ratio

Current ratio: ($18 + $50 + $80) / ($32 + $4 + $8) = 3.36

(b) Quick ratio

Quick ratio: ($18 + $50) / $44 = 1.55

(c) Working capital to total assets

Working capital to total assets: ($148 - $44) / $1,000 = 1.04

(d) Accounts receivable turnover

Accounts receivable turnover: $295 / $55 = 5.36

(e) Age of accounts receivable

Age of account receivable: 365 / 5.36 = 68.1 days

(f) Inventory turnover

Inventory turnover: $140 / $75.5 = 1.85

(g) Working capital turnover

Working capital turnover: $295 / [($148 - $44) + ($174 - $42)] / 2 = 2.50

(h) Net cash flow to current liabilities

Net cash flow to current liabilities: $99 / $44 = 2.25

(i) Profit margin on sales

Profit margins on sales: $83 / $ 295 = .28

(j) Dividend payout ratio (income based)

Dividend payout ratio (income based): $16 / $83 = .19